Understanding Property Damage Claims in Texas Car Accidents

Car accidents can cause significant property damage, not just to your vehicle but also to any personal belongings inside. In Texas, handling property damage claims after an accident ensures you receive the compensation you deserve. From car repairs to claiming compensation for personal items damaged in the collision, this guide explains the steps you need to take.

Step 1: File a Property Damage Claim with the At-Fault Driver’s Insurance

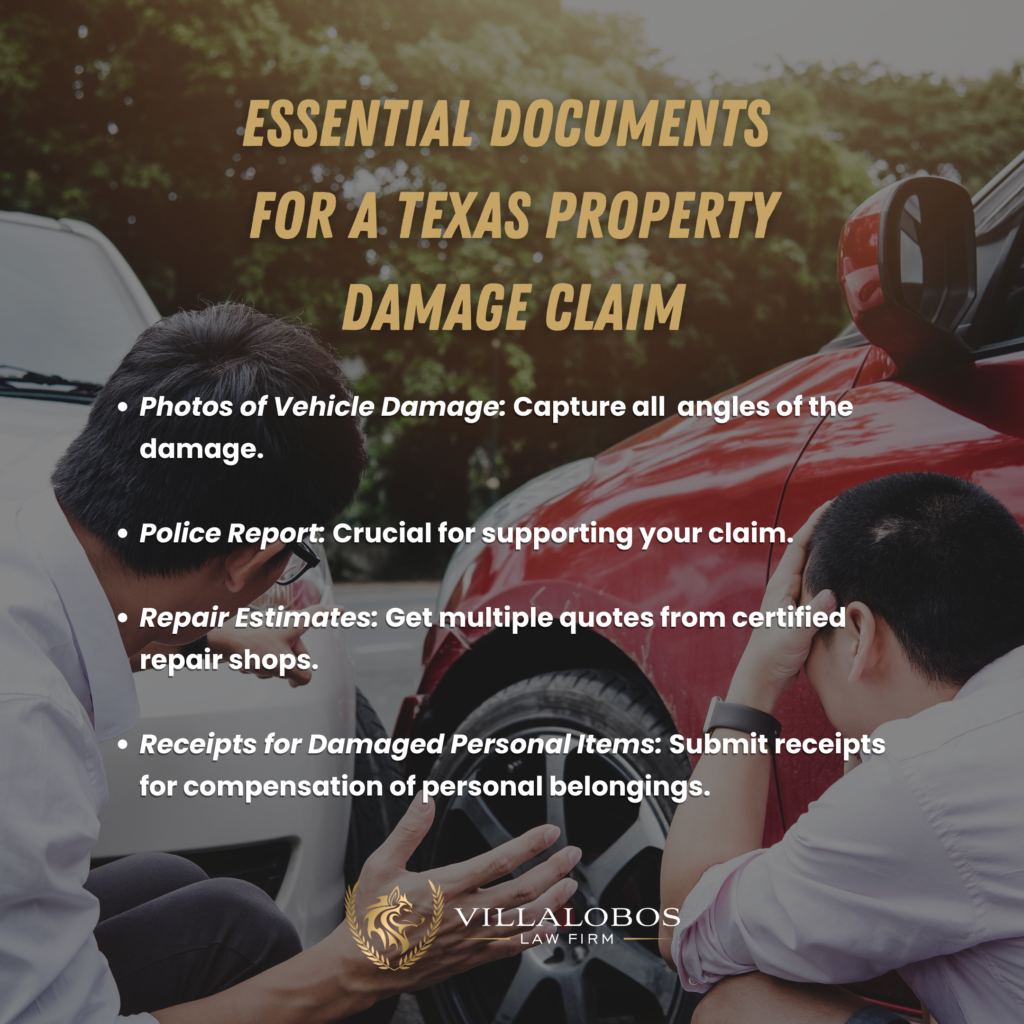

After a car accident, Texas law allows you to file a property damage claim against the at-fault driver’s insurance. The process starts by contacting their insurance company to report the accident and submit your claim. Ensure you provide all necessary information, including photos of the damage, the police report, and witness statements, if available.

Step 2: Get an Estimate for Car Repairs

Once you’ve filed your claim, the insurance company will likely ask you to get an estimate for the cost of repairing your vehicle. In some cases, they may send an adjuster to inspect the damage. Get estimates from reputable auto repair shops to avoid being shortchanged during the settlement process. You can also get multiple estimates to compare costs.

Step 3: What Happens If Your Car Is Totaled?

If the cost of repairs exceeds the value of your car, the insurance company may declare it a total loss. You receive compensation for the actual cash value (ACV) of your car, factoring in depreciation. It’s important to verify the ACV offered to you, as insurance companies sometimes undervalue cars. You can negotiate the payout if you feel the compensation doesn’t reflect the true value of your vehicle.

Step 4: Claiming Compensation for Personal Belongings

Texas law also allows accident victims to claim compensation for personal belongings damaged in the accident, such as electronics, clothing, and other items inside the car. Keep a detailed list of the damaged items, along with receipts or other proof of ownership. Like vehicle repairs, you’ll need to submit this information to the at-fault driver’s insurance for compensation.

Step 5: Uninsured or Underinsured Drivers

If the at-fault driver doesn’t have insurance or carries inadequate coverage, you can use your own uninsured/underinsured motorist (UM/UIM) coverage to file a property damage claim. This type of coverage, which is optional but highly recommended in Texas, helps cover your costs when the at-fault driver cannot.

Step 6: Dealing with Disputes

Sometimes, insurance companies might dispute your claim or offer a settlement that doesn’t cover the full cost of repairs or replacements. If this happens, it’s essential to consult with an experienced attorney. They can help negotiate with the insurance company on your behalf to ensure you receive fair compensation for your property damage.

Step 7: Filing a Lawsuit for Property Damage

If you can’t reach a fair settlement, filing a lawsuit to recover your property damage may be necessary. In Texas, you typically have two years from the accident date to file a property damage lawsuit. Working with a skilled lawyer ensures that legal processes are followed and maximizes your chance of success.

Maximize Your Property Damage Claim

To maximize your property damage claim, remember to:

Consider working with an attorney to ensure your rights are protected throughout the process.

Keep all documentation, including repair estimates, receipts for damaged belongings, and photos of the damage.

Navigating the property damage claims process after a Texas car accident can be overwhelming. From negotiating with insurance companies to ensuring fair compensation, it’s essential to have legal representation to guide you. At Villalobos Law Firm, we have extensive experience handling property damage claims and fighting for our clients’ rights.

Stay Informed and Protected

Stay updated on Texas car accident laws and other legal matters by following Villalobos Law Firm on social media. Our expert insights provide you with the knowledge you need to navigate legal challenges confidently.